Financial Planning in the Age of Climate Change

There is no shortage of financial punditry focused on the interplay between climate change and capital markets. From the risks associated with stranded fossil fuel assets to the investment opportunities linked to climate adaptation, financial professionals are increasingly integrating climate considerations into portfolio management. However, a successful retirement depends on far more than investment returns.

Traditional financial planning inputs such as income, expenses, and emergency funding are just as dependent on a stable climate as the stock market. Inflationary pressures, escalating insurance premiums, and generous government incentives for decarbonization have a growing influence over family budgets that will only increase with each passing year. In this paper, we expand the discussion about climate and money beyond investments and explore the other ways in which a warming world is affecting household finances.

“Climate hazards can cause income loss, increased expenses, and place additional burdens on American household’s savings, credit, and insurance coverage.” U.S. DEPARTMENT OF THE TREASURY 2023

Property Damage

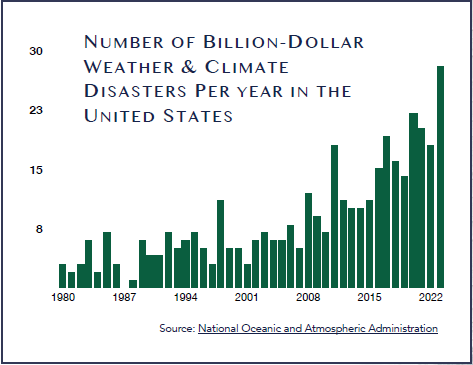

A primary residence continues to be the most significant asset for most Americans. According to the Pew Research Center, 45% of the average American’s net worth is in home equity. Unfortunately, real estate and other physical assets are highly exposed to climate change. Consider that one in ten Americans reported property damage from climate hazards in 2021 alone, generating ~$56.92 billion in damages. It’s a financial burden more families are struggling to shoulder as the average expenditure for emergency home repairs has surged more than 400% in the past three years. Some damages will be covered by insurance, but some will not.

Insurance

The cost of maintaining insurance coverage for extreme weather events may create an even larger drag on household finances. Insurance is particularly ill-suited for a changing climate. Carriers can only offer policies when they can reasonably predict losses, claims, and financial liability. As climate change creates more volatile weather patterns, claims become unpredictable, and the system as we know it begins to break down. Reinsurers, companies that provide insurance to consumer-facing insurance carriers, are responding to this uncertainty by increasing rates as much as 50% (CBS News, 2023). Frontline insurance companies are then passing the cost on to their policyholders or they are pulling out of high-risk markets altogether, further compounding the inflationary pressure by reducing competition. Consequently, homeowners in high-risk areas are experiencing premium hikes as high as 63% (CBS News, 2023). A report from the First Street Foundation shows that a quarter of US real estate is exposed to increasing insurance premiums while warning of an “insurance bubble” in many other regions where climate risk has not yet been priced into the market.

Real Estate Value

Listing agents usually don’t salivate at the prospect of selling homes with sky-high insurance premiums and histories of property damage. Therefore, climate change is significantly impacting property values. The First Street Foundation found that a homeowner in Florida who is dropped by an insurance carrier can expect their property value to decrease by 19% to 40%. Given the prominence of real estate within an average family’s balance sheet, this can have massive implications for financial well-being and retirement planning. Those expecting to inherit wealth in the form of real estate may be surprised to see family estates worth far less than anticipated.

Cost of Living

Unfortunately, climate-driven inflationary pressures are not limited to insurance premiums, as food and other commodity prices are also experiencing upward pressure. At this time, the trend is most noticeable in environmentally sensitive crops. For example, coffee and cocoa prices have experienced extreme price surges due to crop failures and constrained supply (The Wall Street Journal 2024). Add in disruptions to global trade (traffic through the Panama Canal is down 40% due to drought), and the extremely unpopular inflation that has plagued Americans in recent years could become a fixture in daily expenditures. If these issues persist and grow as the climate crisis intensifies, individuals may find that their income needs in retirement are significantly higher than anticipated.

Luckily, not all climate-related financial planning considerations are negative. Adapting to climate change and adopting decarbonizing technologies can save consumers money. For example, installing an efficient heat pump can create between $300 and $1,500 per year in energy savings for an American household (Department of Energy 2024). Such investments may be heavily subsidized through federal and state government programs.

Consumers should familiarize themselves with the credits and deductions associated with the Inflation Reduction Act (IRA) of 2022, various state incentives, and the corresponding restrictions. Here are some examples of IRA incentives for home and vehicle upgrades that can reduce long-term expenses.

- High Efficiency Electric Home Rebate Act

Point of sale discounts up to $8,000 for heat pumps and $840 for electric stoves. - Residential Clean Energy Tax Credit

30% tax credit on home clean energy systems such as solar or geothermal. - Clean Vehicles Credit

Up to $7,500 for new electric vehicle purchases. (Vehicle and income restrictions apply) 30% tax credit (capped at $4,000) for used EV purchases. - Energy Efficient Home Improvement Tax Credit

30% tax credit for energy efficiency improvements such as insulation, windows, and efficient appliances. (Annual caps apply) $150 credit for home energy audits.

Source: Internal Revenue Service

“In so many of the mathematical equations that govern our existence, constants are being replaced by variables.

Income

Some professions are more exposed to climate risk than others, and some workers may find themselves with specious income projections. For example, business models that rely on outdoor labor, such as construction or agriculture, may experience substantial losses in worker productivity. The International Labour Organization predicts that hours worked in these sectors could fall 3.8% by the end of the decade, a casualty of climate-induced high temperatures (Department of Energy 2024). It is inevitable that climate change will affect the earnings of some workers and now is the time to begin preparations for such disruptions.

Retirement Savings

While this paper aims to expand the climate-finance conversation beyond portfolio management, we cannot conclude without highlighting the fundamental risk to retirement accounts. Humanity has enjoyed a stable climate for 12,000 years, and the systems on which we depend were designed for climatic conditions that no longer exist. In so many of the mathematical equations that govern our existence, constants are being replaced by variables. As a result, some economists are becoming increasingly concerned that our forecasting methods are ill-equipped to fully capture the repercussions of climate change. Could computer-generated retirement simulations be fundamentally incapable of projecting outcomes on a warmer planet? It’s a thorny and alarming question, yet one that investors must begin to consider, as immunizing investment portfolios from the effects of climate change will become a critically important.

Taking Action

- Ask your financial planner about the growing dislocation in insurance markets. Inquire about regional risk and how to avoid or prepare for higher premiums.

- Investigate exposure to climate risk before buying or selling real estate, and consider the potential impact of insurance availability on property values.

- Consider building or growing an emergency fund to cover uninsured property damage.

- If you are planning to make home improvements or purchase a new vehicle, look into the federal and state purchase incentives available to you.

- Ask your financial planner about your retirement income needs and if they should be increased to cope with a higher-than-anticipated cost of living.

- Educate yourself and explore the available information from reputable sources such as:

The Impact of Climate Change on American Household Finances

- United States Department of the Treasury

The 9th National Risk Assessment: The Insurance Issue

- The First Street Foundation

Credits and Deductions Under the Inflation Reduction Act of 2022

- Internal Revenue Service

Disclosure

The opinions expressed herein are those of Silvergreen Sustainable Investments and are subject to change without notice. The information presented is for educational purposes only and does not intend to make na offer or solicitation for the sale or purchase of any specific securities product, service, or investment strategy. Investments involve risk, and past performance is not indicative of future results. Therefore, it should not be assumed that any specific investment or investment strategy made reference to directly or indirectly by Silvergreen Sustainable Investments will be profitable. Be sure to first consult with a qualified financial adviser, tax professional, or attorney before implementing any strategy or recommendation discussed herein.

Fixed insurance services offered through Marcio Silveira. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Silvergreen ustainable Investments and Cambridge are not affiliated. Silvergreen Sustainable Investments does not provide tax or legal advice.

This content is available for download in PDF.